Drniki – Find Alpha Course – How to Find New Crypto Projects

$117.00 $35.00

Total Sold: 3

»Instant Delivery

Description

Drniki – Find Alpha Course – How to Find New Crypto Projects

Whales are using on-chain data, entering pre-marketing and are not watching the telegram chat to get manipulated into holding a bag. They enter early and exit at the top. Here’s how YOU can do it!

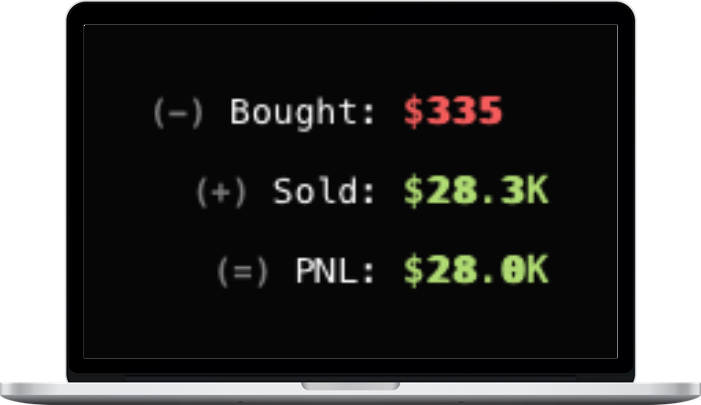

I will show you how whales and early buyers find these gems to get up to 100x or 1000x (a live example of a 300$ to 28k Trade in the course) Here are all of the patterns, strategies and secret tools i use to see data normal retail trades do not see or dont know enough to look for. Normally my targets are 20-30-50% and to find these trades i look for some specific things. I go in, take the trade and move on to the next one. Past performance does not guarantee future results, so I will also try to help you manage your expectations in one of the lessons.

What You’ll Learn In Find Alpha Course – How to Find New Crypto Projects

Genesis & Your ABC in Finding Crypto Gems

- Welcome Message

- Managing Expectations

- Setup Your Wallets

- How to Buy Tokens

- How you choose my levels (Technical Analysis)

- Your Best Friend to View the Charts

The Deep Value & Daily Bias (Forget the chart, look at the on chain data)

- My First Secret Weapon

- My Second Secret Weapon

- This is How I Found These 2 Gems (live case study, 2 whales)

My Strategy and The PATTERNS I Use

- How I FIND Token Cycles – The ONLY Buying and Selling Opportunities

- My Favorite Pattern to Trade

- Follow Their FOOTSTEPS (everything leaves a mark)

- How to Identify our Environment?

- How I Find Tokens That JUST CAME OUT

- This Volume is from Scalping Bots. This is what they do and when they buy and sell (LIVE BACKTESTING)

- How i Check if a Solana project is Legit and Whate are the TOP WHALES Investing in.

- Buy The DIP VS Breakout Pattern

- Market Cap vs Price (INTERESTING CASE STUDY)

The Perfect Exit Doesn’t Exist (But it does)

- How i Timed THESE LIVE EXITS Perfectly – LIVE CASE STUDIES

- The Last EXIT Signal (Environment – case study)

- The Red Flags (vetting a project, case study)

- Committing to a Trade (Live Example of a closed trade, case study)

- The Risk Management Scenarios

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.

Related products

Total sold: 2

Total sold: 2

Total sold: 2