Master Trader – How to Trade M and W Patterns

$27.00 Original price was: $27.00.$11.00Current price is: $11.00.

»Instant Delivery

Master Trader – How to Trade M and W Patterns

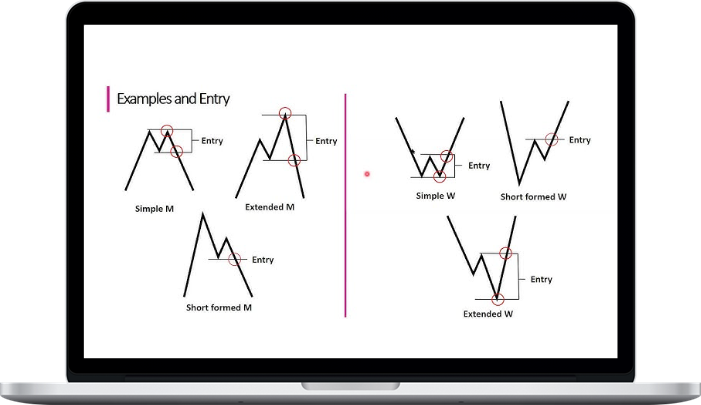

M & W Reversal Patterns display a confirmation of support/demand and often set up fantastic trading opportunities.

Particularly if after taking out prior lows or highs.

With the oversold markets and VIX (Fear Index) rising, learning this key pattern will allow you to profit on the W Pattern that we anticipate setting up in ETFs and stocks.

Candlesticks convey messages of supply and demand. We read those messages and look for high-probability setups using patterns of candlesticks in multiple time frames.

What You’ll Learn In How to Trade M and W Patterns

- The language of M & W Reversal Patterns and why they are one of our favorites to trade

- The high-probability Setups to trade – and when trading with the trend or against

- The psychology behind the patterns, including how to read the messages on smaller time frames

- With the oversold markets, watch us review the Broad Market Index and Sector ETFs for new trade setups and discuss what to look for in trading them

- Trading Tails using Master Trader Strategies (MTS) applies to trading or investing in any Index, ETF, Currency or Commodity in any time frame

More courses from the same author: Master Trader

Related products

Stock Trading

Stock Trading

Stock Trading

Stock Trading

Stock Trading

»Instant Delivery

Anton Kreil – IPLT Introduction to Professional Level Trading 2021