Mike Valtos – Order Flow By The Numbers

$99.00 $29.00

Total Sold: 1

»Instant Delivery

Description

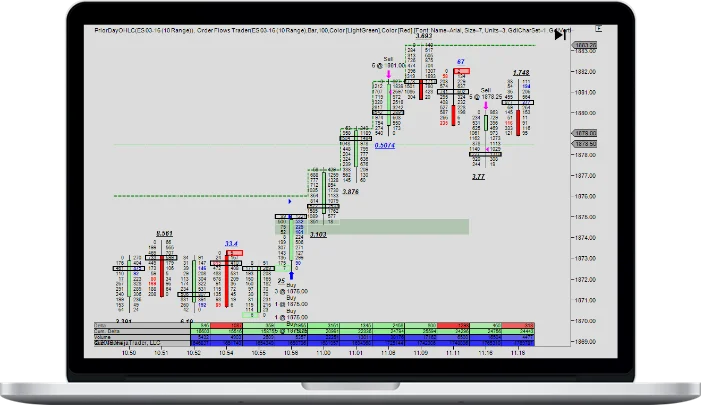

Mike Valtos – Order Flow By The Numbers

This is the deep dive on footprint charts and order flow analysis class I’ve been wanting to put together for months.

What You’ll Learn In Order Flow By The Numbers

- Day 1 — How to read footprints from scratch. Volume hotspots, imbalances, absorption, rotation patterns.

- Day 2 — Advanced application. Volume Rotation Trigger, multi-timeframe analysis, live practice sessions, Q&A.

About Mike Valtos

My name is Michael Valtos and since 1994 I have been trading for banks (JP Morgan and Commerzbank) as well commodity trading houses (Cargill and EDF Man) and for myself. I created orderflows.com to help traders understand and trade with order flow.

Throughout my career I had the good fortune to work with some of the largest traders in the world who would entrust their orders to me for execution. Orders like “buy 5,000 ESH5 over the next 15 minutes.” My goal was to get the best possible execution without impacting the market. I was measured against VWAP for the same time period as calculated on Bloomberg.

You can’t just go in and buy 3,000 lots in one clip. You have to finesse it. You have to not show the world what you are trying to do until you are done. If everyone knows you are trying to buy a lot of contracts, they will raise their bids forcing you to pay higher or even jump ahead of you and buy before you can.

When you look at the trading screens all day every day, you start to notice how the orders come into the market and create opportunities and or distortions in the market. Creating pockets of opportunities to buy or sell at prices that are attractive.

More courses from the same author: Mike Valtos

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.

Related products

Total sold: 17