Price Action Volume Trader – Trading with Market and Volume Profile

$195.00 $49.00

»Instant Delivery

Description

Price Action Volume Trader – Trading with Market and Volume Profile

Learn the theory and principles of Auction Market Theory and how we use Time, Price and Volume to analyze market sentiment, trends and key levels to use in our trading analysis and execution.

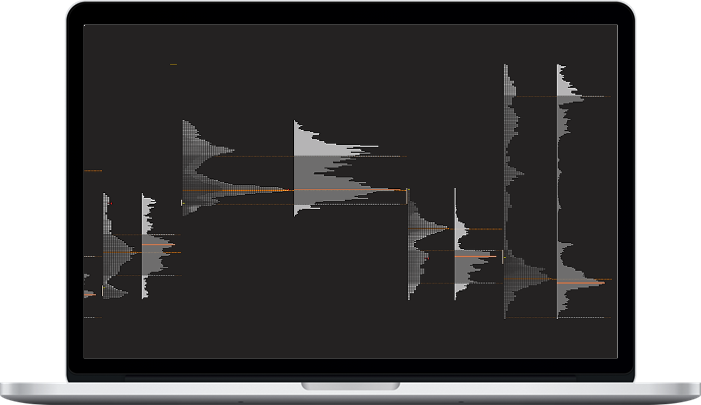

Welcome to the new 2024 course on Market Profile (TPO Charts) and Volume Profile! Auction Market Theory (AMT) is one of the most important tools we can use to study the relationship between time, price and volume.

Through the course we’ll see how this tools can be used in all markets like futures, crypto, forex, cfd’s and stocks. And how we can apply them for both short term day trading as well as swing trading by letting us have a macro view of market structure and the relationship of buyers and sellers.

I include a free download of a Sierra Chart file with all the charts that were used in the recording of the course if you want to use it as a base or customize it to your liking. You can use however any platform of your choice as the concepts are applicable everywhere.

Like with all my other trading courses, there will be future updates coming to expand on the material and bring you the best value and education.

What You’ll Learn In Trading with Market and Volume Profile

- I – Introduction & Sierra Chart Template

- II – What Is Market Profile and History

- III – Advantages of Market Profile

- IV – AMT: Auction Market Theory

- V – Market Participants

- VI – TPO Charts – Value Area, Point of Control, Splits

- VII – Initial Balance

- VIII – Market Profile vs Volume Profile

- IX – TPO Chart Elements

- X – Market Profile Day Types

- XI – Market Profile Open Types

- XII – Market Profile Composites

- XIII – The 5 Auction Market Theory Rules

- XIV – Performing A Complete Top Down Analysis

- XV – Trade Strategies Using TPO and Volume Profile

- XVI – Conclusion

More courses from the same author: Price Action Volume Trader

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.