Rene Le Cornu – Trade the Markets like a Professional

$100.00 $55.00

Delivery: Within 7 days

Description

Rene Le Cornu – Trade the Markets like a Professional

Have you ever wondered how some traders make consistent profits while others seem to always be struggling? The difference often lies in their understanding of market psychology, technical indicators, and trading strategy. But the journey to trading proficiency doesn’t have to come at the cost of countless losses.

Why This Course?

- Cost-Effective Learning: The cost of learning doesn’t mean losing money on bad trades. Equip yourself market understanding to avoid common and costly trading pitfalls.

- Master Market Psychology: Emotions play a critical role in trading. Our course delves deep into understanding market psychology, teaching you how to leverage and manage emotions to make sound trading decisions.

- Expert Trading Strategies: Explore a plethora of trading strategies and find the one that suits your trading style and goals. Whether it’s trend-following, breakout trading, or long-term position trading, we’ve got you covered.

- Risk Management Essentials: Learn how to protect your capital with risk management principles. Understand the nuances of position sizing, money management, and how they work together to safeguard your trading portfolio.

What You’ll Learn In Trade the Markets like a Professional

Introduction

- Introduction to Trading

Trading Fundamentals

- Economic Indicators and Their Impact on the Markets

- Individual Company Financial Statements and Ratios

- Conclusion

Charts

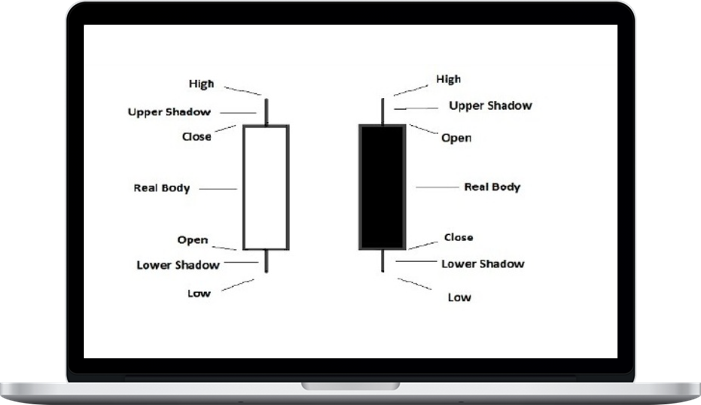

- Different Types of Charts

- Interpreting Candle Stick Charts

- Importance of Timeframes in Chart Analysis

- Overview of Different Timeframes and Their Applications

- Minute Charts

- Hourly Charts

- Daily Charts

- Weekly Charts

- Choosing the Right Timeframe for Your Trading Style

- Introduction to Multi-Timeframe Analysis

- Timeframes in Trading – A Top Down Approach

- Timeframes in Trading – A Bottom Up Approach

- Combining Timeframes for Better Trade Decisions

- Timeframes in Trading – Summary

Interpreting Chart Patterns

- Understanding Chart Patterns

- Market Participants and Their Influence on Market Psychology

- Single Bar Patterns – Gaps and Windows

- Single Bar Patterns – Doji Candlestick Patterns

- Single Bar Patterns – Hanging Man Candlestick Pattern

- Single Bar Patterns – Shooting Star Candlestick Pattern

- Single Bar Patterns – Hammer and Inverted Hammer

- Market Psychology of Chart Patterns

Identifying Market Trends

- Trend Indicators

- Support and Resistance Levels

- Types of Trends

- Trend Direction

- Market Sentiment: Understanding Bullish, Bearish, and Neutral Market Psychology

- Basic Trend Trading Strategies

Support and Resistance

- Understanding the Basics of Support and Resistance.

- Types of Support and Resistance

- Importance of Support and Resistance in Trading

- Market Psychology behind Support and Resistance Levels

- Analyzing Candlestick Patterns at Support and Resistance Levels

- Setting Entries and Exits Using Support and Resistance

- Setting Risk Limits for Support and Resistance Trades

- Implementing Support and Resistance Strategies: Bounce Trading Strategy

- Implementing Support and Resistance Strategies: Breakout Trading Strategy

- Implementing Support and Resistance Strategies: Fakeout Trading Strategy

- Combining Support and Resistance Strategies for Optimal Results

Technical Indicators

- Introduction to Technical Indicators and Market Psychology

- Moving Averages

- Moving Averages – Traders Thoughts

- Fibonacci Retracements

Oscilators

- What is an Oscillator

- The Relative Strength Index (RSI)

- The Stochastic Oscillator

- Moving Average Convergence Divergence (MACD)

- The Commodity Channel Index (CCI)

- Williams Percent Range

- Generating Entries with Oscillators

- Understanding the Use of Oscillators in Trading

Trading Strategies

- Introduction to Trading Psychology Techniques

- Trend-Following

- Break Out Trading

- Chart Pattern Breakouts

- Volatility Breakouts

- Counter-Trend Trading

- Divergences

- Oscillator Overbought/Oversold Conditions

- Range Trading

- Support & Resistance Bounces

- Moving Average Crossovers

- Day Trading

- Scalping

- Momentum Trading

- Swing Trading

- Moving Average Pullbacks

- Long-term Trend Following

- Fundamental Analysis

- Long Term Position Trading

- Algorithmic Trading

- Bollinger Bands Squeeze

- Fibonacci Retracements & Extensions

- Conclusion

Risk Management

- Importance of Risk Management in Trading

- Introduction to Position Sizing and Money Management in Trading

- How Position Sizing and Money Management Work Together

- The Need for Adaptability and Flexibility

- Position Sizing and Risk Management

- Risk Management – Final Thoughts

Market Psychology and Trading

- The Role of Market Psychology in Trading

- Emotions in Trading

- Fear and greed

- Optimism and pessimism

- Euphoria and panic

- The Four Key Emotions Fear, Greed, Hope, and Regret

- The Impact of Fear on Trading Decisions

- The Impact of Greed on Trading Decisions

- The Impact of Hope on Trading Decisions

- The Impact of Regret on Trading Decisions

- Overcoming Emotional Barriers in Trading

- Building Emotional Resilience in Trading

- Building a Strong Trading Mindset

- Stress in Trading

- Avoiding Impulsive Trades

- Developing a Consistent Trading Approach and Discipline

- Goal Setting

- Journaling

- Visualization

- Mindfulness

Developing a Trading Strategy

- Introduction

- Step 1 – Identify Your Trading Goals

- Step 2 – Choose a Trading Method

- Step 3 – Develop a Trading Plan

- Step 4 – Backtesting

- Step 5 – Forward Testing

- Step 6 – Refine and Optimize Your Strategy

- Order Types and Execution

Develop Your Trading Plan

- Goals, Style and Strategy

- Creating a Trading Plan and Sticking to It

- Key Components of a Trading Plan

- Importance of Adaptability in Trading

- Monitoring Market Conditions

- Adapting to New Market Conditions

- Developing a trading plan that accounts for market psychology

- Techniques for managing emotions while trading

Live Trading and Portfolio Management

- Live Trading and Portfolio Management

Conclusion

- Summary

- The Ongoing Journey to Mastering Market Psychology and Technical Indicators

- Embracing Adaptability and Growth in Your Trading Approach

- Case Studies: Successful Traders and Their Use of Market Psychology and Technical Indicators

- Trading Rules to Remember

More courses from the same author: Rene Le Cornu

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.