Mike Valtos – Orderflows Winter Trading Program

$197.00 $49.00

Delivery: Within 7 days

Description

Mike Valtos – Orderflows Winter Trading Program

7-Week Advanced Order Flow Mastery Course

What You’ll Learn In Orderflows Winter Trading Program

Rethinking Order Flow: An Ecosystem Approach

Discover why traditional supply/demand thinking fails in modern algorithmic markets. Learn to map the complex interactions between retail traders, institutions, HFT algorithms, and market makers — revealing opportunities invisible to conventional analysis.

Hidden Patterns: Beyond Conventional Metrics

Move past standard indicators and discover ghost liquidity, spoofing trails, and emergent volume clusters. Train your eye to spot the “invisible hand” — the subtle anomalies that precede major moves but are completely missed by conventional techniques.

Algorithmic Shadows: Identifying Machine Intent

With algorithms accounting for 70-80% of market volume, you need to distinguish human from machine behavior. Learn to identify HFT pinging, quote stuffing, and algorithmic liquidity provision patterns that reveal where price is headed in the next seconds to minutes.

Cognitive Biases in Tape Reading

Even perfect order flow analysis becomes useless if cognitive biases distort your interpretation. Identify the psychological traps that cause traders to misread the tape — and implement practical techniques for maintaining objectivity during high-stress markets.

Emotion-Adjusted Delta: Turning Flow Into a Lie Detector

Not all volume is created equal. Learn to create custom delta indicators that incorporate fear and greed signals, making them exponentially more predictive. Detect when aggressive buying is actually panic covering (reversal signal) vs. conviction accumulation.

Prospect Theory in Practice: Fear Spikes and Greed Clusters

Humans feel losses twice as intensely as gains, creating predictable order flow distortions. Learn to identify “fear spikes” (sudden bid withdrawals) and “greed clusters” (ask layering during euphoria) — building setups specifically designed to exploit emotional responses.

Order Flow in Illiquid and Emerging Markets

Thin liquidity magnifies every order flow signal. Master analysis in crypto, microcaps, and after-hours sessions where institutions can’t hide — revealing order flow mechanics in their purest form and creating high-reward opportunities.

Detecting Hidden Intent: Beyond the Tape and Book

Sophisticated institutions deliberately hide their intentions using icebergs, dark pools, and cross-market positioning. Learn cluster analysis, print sequence reading, and correlated market techniques to infer what you CAN’T see from what you CAN.

Anchors and Endowment Effects: Sticky Levels

Traders irrationally cling to certain price levels (VWAP, round numbers, prior day close) creating “sticky” zones where order flow behaves predictably. Learn to measure “anchor decay” — when conviction at a level is weakening, signaling impending breaks.

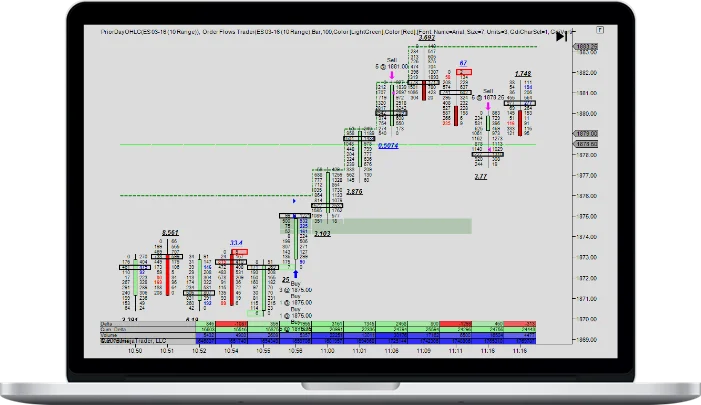

Creative Visualization: Beyond Footprints and Delta

Standard charts are one-dimensional representations of multi-dimensional data. Explore innovative visualization methods that reveal patterns completely invisible on traditional displays — custom tools that create proprietary edge.

Regret, FOMO, and Order Book Dynamics

FOMO and regret create the most explosive and tradeable order flow events. Learn to recognize the order flow signature of emotional cascades and position BEFORE the crowd panics in or out — capturing the most violent and profitable moves.

Algorithmic Intent: Detecting Bots, Spoofs, and Hidden Agendas

Algorithms don’t just participate — they create false signals to trap retail traders. Master the telltale signatures of HFT bots, spoofing, and layered algos. Learn to see through algorithmic illusions and profit from their predictable behavior.

Building Your Own Flow Indicators: From Concept to Code

Off-the-shelf indicators give everyone the same information — which means no edge. Learn to build proprietary tools that incorporate your unique insights using NinjaTrader. Transform from indicator consumer to indicator creator.

Building Your Personal Unconventional Flow Playbook

Synthesize everything into a cohesive, personalized trading system. Document your custom indicators, preferred setups, and risk management rules. Establish peer accountability systems and create a blueprint for continuous improvement and long-term mastery.

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.

Related products

Total sold: 3