Equity Echo – Understanding Trading Volatility: Risks and Opportunities

$19.99 Original price was: $19.99.$14.00Current price is: $14.00.

Delivery: Within 7 days

Equity Echo – Understanding Trading Volatility: Risks and Opportunities

In this course, students will gain a comprehensive understanding of volatility in trading and how it affects market behavior. Designed for both beginners and experienced traders, this course breaks down complex concepts into actionable insights and strategies to harness the power of volatility for profitable trading. Each module is crafted to give learners the tools they need to confidently navigate high and low volatility markets, manage risk effectively, and make informed trading decisions.

By the end of the course, students will have a solid grasp of volatility as a core concept in trading, be equipped with practical strategies, and understand how to navigate different market conditions to minimize risks and capitalize on opportunities.

What You’ll Learn In Understanding Trading Volatility: Risks and Opportunities

Foundations of Volatility:

- Understand what volatility is, why it occurs, and its role in financial markets.

- Learn the difference between historical and implied volatility.

- Study real-world examples of volatility in different asset classes (e.g., stocks, forex, commodities).

Measuring Volatility:

- Explore volatility indicators such as the VIX (Volatility Index), Bollinger Bands, and ATR (Average True Range).

- Learn how to interpret these indicators to assess market sentiment and predict price movements.

Factors Driving Volatility:

- Analyze the primary causes of market volatility, including economic data releases, geopolitical events, interest rates, and investor sentiment.

- Understand the impact of high-impact news events on asset prices and how to prepare for these scenarios.

Volatility Trading Strategies:

- Develop strategies specifically for volatile markets, such as options trading (e.g., straddles, strangles) and hedging tactics.

- Learn the fundamentals of position sizing, stop-loss settings, and leverage to manage risk effectively in volatile conditions.

- Implement real-time strategies for both high and low volatility environments to capitalize on market swings.

Risk Management and Psychology:

- Master the psychological aspects of trading in volatile markets, such as managing emotions like fear and greed.

- Discover the importance of discipline, patience, and decision-making in high-stress market conditions.

- Use practical exercises and case studies to strengthen mental resilience and maintain a clear, objective perspective.

Practical Applications and Case Studies:

- Apply knowledge gained with real-world case studies and simulations that demonstrate volatility concepts in action.

- Work through historical market scenarios and understand how volatility played a role in key financial events.

More courses from the same author: Equity Echo

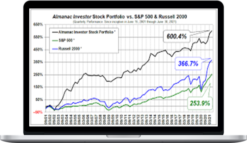

Related products

Stock Trading

Stock Trading

Stock Trading

Stock Trading

Stock Trading