Value Investing Monster – 5-Step Value Investing Formula

$84.99 Original price was: $84.99.$9.00Current price is: $9.00.

»Instant Delivery

Value Investing Monster – 5-Step Value Investing Formula

In 5-Step Value Investing Formula, you will learn how to become a profitable value investor by screening, analyzing, and identifying high performing and undervalued stocks.

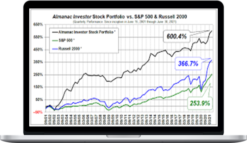

Value Investing is the only proven stock investing method since the 1920s which focuses on looking at stocks as a business rather than a moving stock price. It is also the only investing methodology where you are required to know how much the business is worth- its Intrinsic Value- before you invest, and include a Margin of Safety to take care of any possible errors in calculation. It is a highly conservative method. Value stocks tend to outperform growth stocks in global markets.

Is beating the market just a dream? How is it possible for an ordinary person- more importantly for you, to make this a reality?

The secret to wealth is simple: You need a formula. A formula makes investing easy to understand.

Value investing is actually quite simple- if you know how to take the right steps- but let’s be honest here; Google and books don’t do a good job in explaining things, do they?

I will take you by the hand and show you EVERYTHING on how it can be done. The concept is simple, the explanation is simple, but most important of all, the execution is simple enough for you to do on your own. This formula does only 1 thing. It helps you buy above-average companies, but only when they are available at undervalued prices.

What You’ll Learn In 5-Step Value Investing Formula?

- In 5 actionable steps, find great stocks at undervalued prices.

- Calculate the real value of your stocks using the VIM calculator.

- Create your own stock watch list, and confidently buy value stocks in the market.

- Reduce your risk in investing by 30% through margin of safety.

Who 5-Step Value Investing Formula is for?

- People who want to invest in stocks but never got started.

- Value investors who want a clear step-by-step blueprint for them to follow.

- Investors who experience analysis paralysis, and want to make value investing simpler and more methodological.

- Investors who want to increase their investment returns through value investing.

About Value Investing Monster

Value Investing Monster (VIM) was founded with the purpose of bridging the information gap between learning value investing and actually putting it to use.

While there are many available information on the concepts and principles of value investing; there is a lack of resources that actually guides investors on actionable steps in screening and identifying value stocks. The VIM team aims to help you achieve just that.

More courses from the same author: Value Investing Monster

Related products

Stock Trading

»Instant Delivery

Stock Trading

Stock Trading

Stock Trading