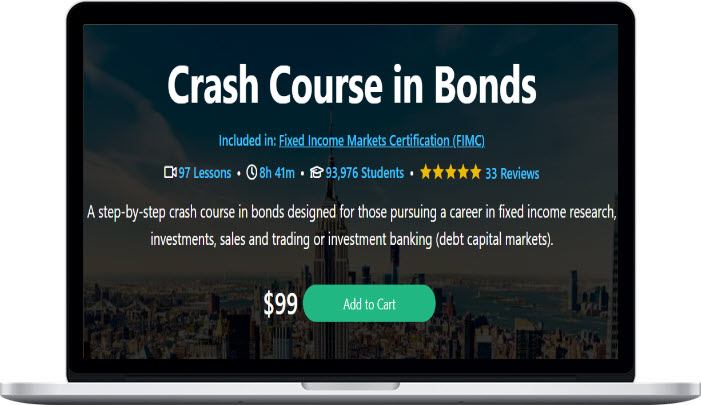

Wall Street Prep – Crash Course in Bonds

$99.00 $35.00

»Instant Delivery

Description

Wall Street Prep – Crash Course in Bonds

A step-by-step crash course in bonds designed for those pursuing a career in fixed income research, investments, sales and trading or investment banking (debt capital markets).

If you’ve ever tried to learn about bonds – either through a textbook, a university class, or CFA training materials, you’ve most likely discovered that it quickly gets painful. We’ll be blunt: bond analysis is usually taught horribly. Beyond super-basic concepts of bond pricing and interest rate valuation, concepts like convexity, modified duration and forward curves are introduced with no connection to how they relate to real-world investment strategies.

We made this bonds course with one overall objective in mind: to make something truly different than what’s out there now. Something that completely demystifies fixed income analysis and gives people a clear window to the inside.

We feel certain we’ve accomplished this. We take you step-by-step through the core concepts you need, and completely cut out concepts you’ll never use. The result is an intuitive look at the use of bonds in fixed income research, sales and trading and investment banking.

What You’ll Learn In Crash Course in Bonds?

- Fixed income market overview

- Bond math basics

- Yield calculations and conventions

- Money Market math

- Interest rate risk

- Real world bond pricing nuances

- Callable bonds

- The yield curve

- Nominal spread & Z-spread

- OAS

- Spot rates

- Realized compound yield

- Holding period yield

- Forward rates

- Credit analysis

- Debt Capital Markets

More courses from the same author: Wall Street Prep

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.