Stratagem Trading – Newton’s Cradle and Shortfly & Condor

$799.00 $319.00

Delivery: Within 7 days

Description

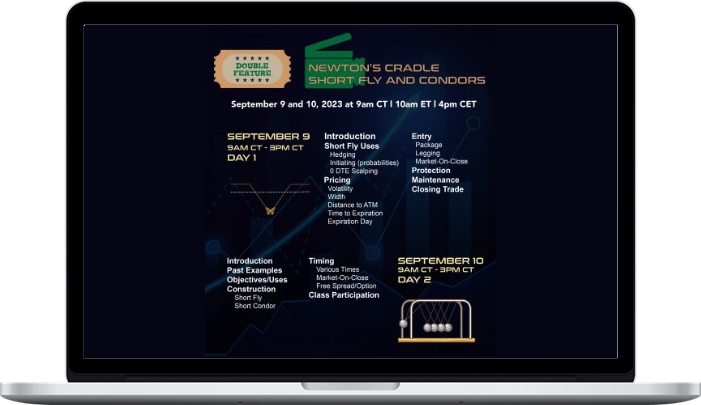

Stratagem Trading – Newton’s Cradle and Shortfly & Condor

When you see a short butterfly being hedged with a cheap vertical spread and the risk-graph goes from have large risk to no-risk and a long vertical at completely different strikes, it looks like a Newton’s Cradle game.

Creating a short butterfly (or condor) can be a very favorable alternative to closing out a vertical spread that is moving the wrong way.

What You’ll Learn In Newton’s Cradle and Shortfly & Condor

Class Recordings (~12 hours)

Handout of Class Slides

Bonus Materials: Three-Legged Box Example (7 pages) and Layer Spreads (17 pages)

Bonus Class Recordings:

- New Game Plan

- Live: 3-Legged Box

- Box Spread

- Newton’s Cradle and Short Fly Primer

- Advanced Butterfly Sale

- Practical Short Fly Example

More courses from the same author: Stratagem Trading

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.