Todd Mitchell – Advanced Iron Condors, Trading Concepts

$397.00 $78.00

»Instant Delivery

Description

Todd Mitchell – Advanced Iron Condors, Trading Concepts

To show you step-by-step how to apply a comprehensive and dynamic risk management plan that allows you to neutralize risk on the fly.

What I can tell you now is that defending your trades requires a layered approach.

What You’ll Learn In Advanced Iron Condors, Trading Concepts?

- The first is general risk management. In this layer, you define how much you can risk on one trade.

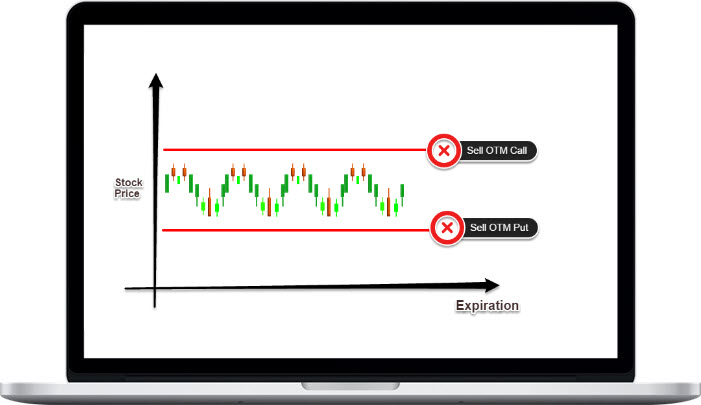

- The next layer is static risk management. You basically ask yourself, “What is the stop value at which I can remove one of my credit spreads and roll it out further in distance?”

- You then top this foundation by determining how much dynamic risk you can tolerate. You also find out if you can add any hedge positions to neutralize your risk.

- Next up is a dynamic risk management layer. You see, certain positions placed ahead of time can not only dynamically grow in value, but also help defend against a deep attack on your credit spread positions.

- I call these your “sleep-at-night” positions.

- You then conclude with active risk management. This final step involves evaluating the potential reward of staying in a position longer versus the potential risk of additional market movement, as well as when it’s time to close your position for maximum profits

More courses from the same author: Todd Mitchell

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.