Corporate Finance Institute – Applied Fixed Income

$997.00 $27.00

»Instant Delivery

Description

Corporate Finance Institute – Applied Fixed Income

Build on your fixed-income fundamentals by diving deeper into government-issued debt, zero-coupon bonds, floaters, linkers, callables, and putables.

- Master government, agency, and sovereign/supranational bonds

- Understand the difference between specialized fixed income instruments like zeroes, floaters, and linkers

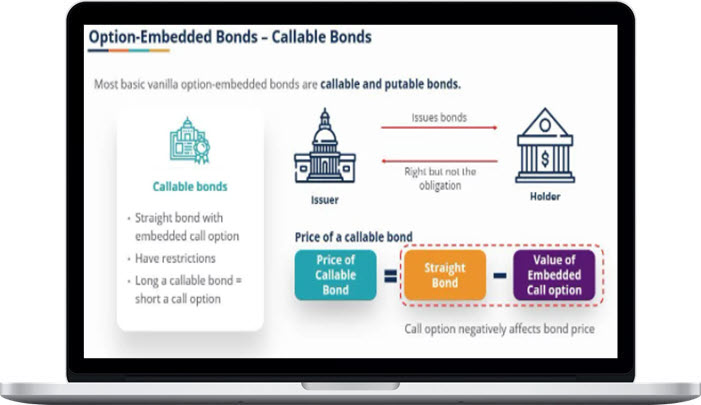

- Learn how to price callable and puttable bonds

This Applied Fixed Income course builds on the fixed income fundamentals and delves deeper into government & agency-issued debt, zeroes, floaters & linkers, and callables & putables. It provides knowledge on how they are priced with industry-relevant examples of each type of debt. You will work through practice examples of certain types of debt and learn how to identify critical information on Refinitiv Workspace. By the end of this course, you will have an enhanced understanding of fixed-income products, which will prepare you for learning advanced fixed-income courses.

This Applied Fixed Income course is perfect for anyone who wants to build up their understanding of fixed-income products. This course is designed to equip anyone who desires to begin a career in the capital markets on the fixed income desk.

What You’ll Learn In Applied Fixed Income?

- Describe the different types of fixed-income products, their issuers, and investors

- Understand in-depth their pricing, duration, and convexity

- Understand how to calculate bond yields from Bloomberg

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.