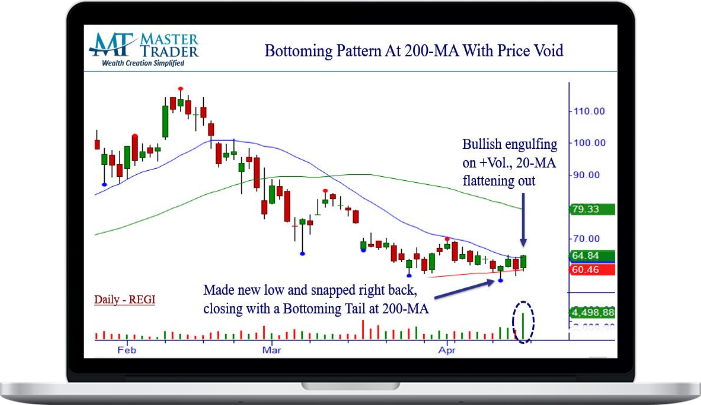

Master Trader – Bottoming Patterns: Don’t Trade Them Without This Setup!

$27.00 Original price was: $27.00.$11.00Current price is: $11.00.

»Instant Delivery

Master Trader – Bottoming Patterns: Don’t Trade Them Without This Setup!

Master Traders use different price patterns for different market environments.

In this short course, we will discuss and review bottoming patters that emerge when the markets are oversold.

When stocks are in bear market territory – many set up.

However, this course can be traps to the uneducated trying to “pick bottoms.”

Don’t let this be you falling to the bottom!

Master Traders Never Do!

The quality bottoms provide intelligently entries – and profits – if done objectively.

Others can be a bottomless pit for the uneducated investor and trader.

What You’ll Learn In Bottoming Patterns: Don’t Trade Them Without This Setup!

- How to recognize quality Bottoming Patterns and the high-probability setups

- How to use Multiple Time Frames (MTM) and the Price Void to maximize reliability

- Profiting when patterns fail

- Watch us scan for new trade setups in Stocks and ETFs and discuss what to look for in trading them

- These setups using Master Trader Strategies (MTS) applies to trade or investing in any Index, ETF, Currency or Commodity in any time frame.

Related products

Stock Trading

Stock Trading

Stock Trading

»Instant Delivery

»Instant Delivery

Stock Trading

Forex Trading