Stock Trading

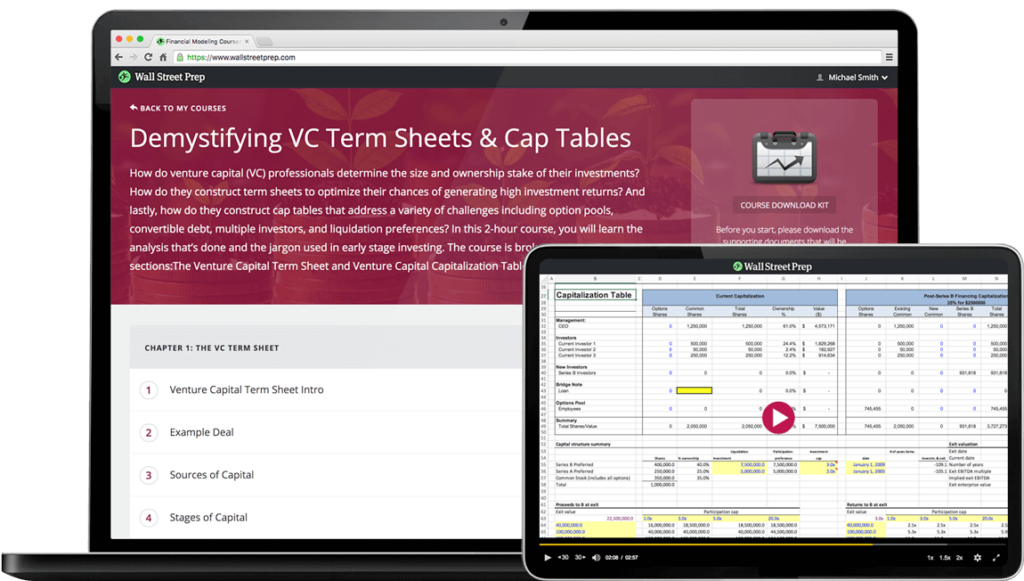

Wall Street Prep – Demystifying VC Valuation, Term Sheets & Cap Tables

Wall Street Prep – Demystifying VC Valuation, Term Sheets & Cap Tables

Understand the analysis that’s done and the jargon used by venture capital professionals in early-stage investing in this recording of a training delivered by Wall Street Prep to Venture Capital professionals. While no prior experience is required, this venture capital course moves at a very fast pace.

Understand Venture Capital Valuation, Term Sheets and Cap Tables

How do venture capital (VC) professionals determine the size and ownership stake of their investments? How do they construct term sheets to optimize their chances of generating high investment returns? And how do they construct cap tables to address challenges including option pools, convertible debt and multiple investors?

The 2-hour venture capital valuation course will demystify the analysis that’s done and the jargon that’s used in early-stage investing.

What You’ll Learn In Demystifying VC Valuation, Term Sheets & Cap Tables?

Part 1: The VC Process and Term Sheet

- The early-stage investing landscape

- A typical VC deal process and timeline

- VC return economics – why they need to hit home runs

- VC Valuation – back-solving into a pre-money / post-money valuation

- Understanding VC term sheets

Part 2: VC Math and Cap Tables

- Cap Table Math: Dilution and price per share after new round

- Calculating Impact of Option Pool

- Calculating Impact of Multiple Investors

- Calculating impact of Convertible Debt

- Constructing a Cap Table

- Flow of Funds and Distribution Waterfall

More courses from the same author: Wall Street Prep

Please contact us to buy this course:

Wall Street Prep – Demystifying VC Valuation, Term Sheets & Cap Tables

Original Price: 99$

You Just Pay: 40$