Wall Street Prep – Money Markets

$79.00 $25.00

»Within 24 hours

Description

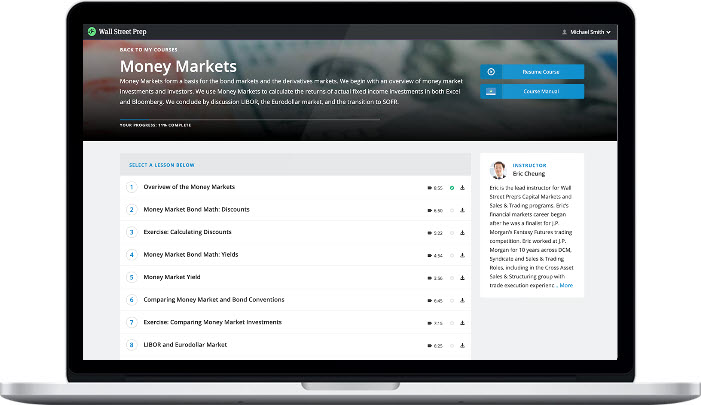

Wall Street Prep – Money Markets

Description of Money Markets

Money markets form the fundamental building blocks for bonds and derivatives. Master money market bond math, both in Excel and on Bloomberg.

Why You Should Take This Course?

- Understand money market investors and investments

Explore supply and demand dynamics. Who are issuers borrowing in the money markets and who are the investors investing in money markets? We discuss how LIBOR and SOFR are based on money market rates and form the basis of the gigantic 100 trillion+ sized interest rate derivative market.

- Build a foundation in bond math

This course provides the foundations for Bond math used in other courses. By comparing single period cashflows, we discuss settlement conventions, accrual periods and yield calculations which are fundamental — whether you are working in money markets or any other part of the Fixed Income market.

- Learn how to convert between conventions, and the impact on returns

Work through actual investments that pay on a discount basis, on a yield basis, using actual/360 days and 30/360 days. Work through the dollar impacts of each, and how to find the equivalent yield for all these securities. See how you can use Bloomberg to calculate cashflows and compare investments that use different conventions in the same terms.

THIS COURSE HAS EVERYTHING YOU NEED TO WORK WITH MONEY MARKET INVESTORS AND INVESTMENT. YOU’LL BUILD A FOUNDATION IN BOND MATH, WORK THROUGH ACTUAL INVESTMENTS, AND SEE HOW YOU CAN USE BLOOMBERG TO HELP.

What you will learn?

- Commercial Paper

- Bloomberg

- Discounts

- Money Market Yield

- LIBOR/SOFR

More courses from the same author: Wall Street Prep

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.